The Cosmos Ecosystem & All You Need To Know

Welcome to the Cosmos Tutorial

Here I will guide you on a journey through the Cosmos in this ever evolving ecosystem of interconnected blockchains also known as the “The Internet of blockchains” So what is Cosmos & the Cosmos ecosystem all about you may ask? Well it all started with the Idea that instead of just having separate blockchains like bitcoin or ethereum, among many others that couldn’t communicate with each other, we could have an ecosystem where blockchains are all connected & therefore allowing what’s known as interoperability, meaning they are connected & can interact with each other in a fast & easy way. In other words Cosmos is simply an ecosystem of blockchains that can scale and interoperate with each other.

So where do you start in The Cosmos Ecosystem?

Well to begin with you want to start with the native cryptocurrency, Cosmos Atom as this is your gateway to the cosmos. This can be purchased on Coinbase for example here. I recommend a min of 10 of these tokens, the more the better & I’ll explain why later. Then once you have some off this you can start to get involved in this fascinating ecosystem of high APYs, growth & passive income. Ah you say, passive income, how does that work exactly? Well quite simply passive income is something we should all be striving for, especially in the current economic climate. Passive income is way to earn an income in a very passive way, meaning very little effort to actually earn it. A famous Investor & one of the richest men on the planet called Warren buffet once said “If you don’t find a way to make money while you sleep, you will work until you die” So basically you want to earn income while you’re sleeping, in the gym, on the beach etc etc. I think I’ve made my point here but just to be clear, you do have to take some action to get passive income & you will have to put a small amount of effort in from time to time, even if its just to login to check your investments or move funds around. So go get some of that Cosmos Atom & get ready to earn some passive income, I’ll explain next how to do it.

Cryptocurrency Staking.

Staking a cryptocurrency is a way to earn a passive income with your existing portfolio, so instead of just holding it in a non custodial wallet or on an exchange watching the price go up & down, you can stake it instead & earn daily rewards. I’ll explain briefly how it works so you have a basic understanding. Staking a cryptocurrency like ATOM, is a way for you to help what’s known as a “proof of stake” or “proof or work” network to achieve consensus, basically approving & verifying transactions on the blockchain. For doing this you receive rewards in the form of new coins, in this case it would be more ATOM coin. Basically you’re earning interest on it, typically this is around 14% APR for Atom at the time of writing & for some of the other cryptos in the Cosmos ecosystem it can be over 100%. Juno for example is currently paying 104%. Just be sure that when you do stake any cryptocurrency you leave a little back for transaction fees, same as you would for GAS fees on the Ethereum network but the difference here is the fees in Cosmos ecosystem are minimal, like pennies, unlike the high GAS fees on Ethereum network. You can go ahead and stake Atom on most exchanges like Coinbase but you wouldn’t want to do this because you don’t own the coins, get very little APR & won’t get any airdrops, (I’ll tell you about airdrops shortly). Also you can stake it in a third party non custodial wallet like Exodus which you do own the coins but again not the best choice if you want to take advantage of airdrops unless you link your Exodus wallet to another wallet like Keplr wallet to be eligible for airdrops. I did this myself as I already had my Atom staked a long time ago in Exodus wallet, you can watch a video here where I show how to stake Atom in Exodus wallet. Keplr wallet though is the preferred choice here for the Cosmos ecosystem, so go ahead & download it here. If you’re using Google chrome for example, click “Install Keplr for chrome” on the home page. Once you have done that you will be presented with a couple of options, either “Import an existing account’ or “Create a new one”. In my case I clicked the ‘Import an existing account” & imported my Exodus wallet but if you want to create a new one use this tutorial from Liam at confident in crypto. Also another option is to “Import Ledger” if you have one of those. Once that’s done you’re ready to explore the Cosmos & start staking & earning yield. One other important thing to remember & I cannot emphasise this enough is wallet security. Make sure you write down any seed phrases on paper & keep that safe, super safe like in an actual safe, fireproof is best. Don’t keep the seed phrase on a digital device, this could get hacked, so bear this in mind & don’t use public wifi networks to transact. There is a whole lot more to security which needs to be covered in a separate article. Also lots on info online about this but just make sure you take your time & do your research.

How to Stake Cryptocurrency.

Now you have your Keplr wallet all set up, you’re ready to start staking. To get started, look up to the top right hand side of your Chrome browser & you will see a blue K, click that & Keplr will open up for you to sign in. Hopefully you already know all this after watching the above video from Liam at Confident in Crypto but in case not I’ll give you a quick “how to stake crypto”. Once you have your Keplr wallet open & signed in, go ahead & click the “Stake” button on the bottom of the wallet. This will open up a new tab in your browser called Keplr, on this page is all the options available for staking. At this point I’m assuming you now have some Cosmos Atom to stake, so we will go with that. You will see a list of validators, the validatiors are who you choose to stake your tokens with, you are then a delegator as you delegate your tokens to a validator. In the list of validators you will see some like Coinbase custody, Binnance staking and kraken, these are centralised exchanges, don’t choose these as you will see they have high commissions & you won’t be eligible for airdrops either. Kraken for example has a 100% commission at the time of writing meaning you won’t get any rewards at all for staking. So choose one with a lower commission rate & take your time choosing. Once you have picked one you like the look of, it’s time to delegate some tokens. In the drop down box, you will see that it says delegate, click that. Now select the amount of tokens you want to delegate & a window for fees will pop up, here you can choose your gas fee, either low, medium or high. Low fees take longer to do the transaction & vice versa, high fees will be faster. So select your prefered fee & click ok, now you will see that you have now staked your tokens. Each day, or week whichever suits you can open your wallet & click claim, a window will pop up again with the fees to choose from, choose your fee & congratulations you have successfully claimed your rewards. You are now earning passive income & now you can decide on what to do with your extra income. You can take it & spend it by cashing out your rewards for cash or a stable coin or you can choose to compound your rewards back in & take advantage of what’s known as the power of compound interest. If you choose the later, then you will see your portfolio grow & grow more each week. If you don’t know what compound interest in you can google it or I can give you a short explanation. Compound interest is where you put back in what you just earned in interest so then you are not only earning interest on your initial capital but also on the interest & as you can imagine, its like a self perpetuating machine earning more & more as time goes on. You can even check how much money you can make over time using a compound interest calculator like this one. Go have a play with it & you will see what I mean, try to even add some funds monthly & you will be pleasantly surprised. Also for some inspiration & ideas go check out a video from Cryptocito on YouTube, he shares what he’s doing with his portfolio in the Cosmos.

Airdrops & what are they?

Airdrops are what new cryptocurrency start up projects use to get their new coins or tokens out to the communities. To be eligible for airdrops, you need to stake a minimum number of coins at the time of the snapshot & this is why I said earlier the more you have staked the better, so you receive more new crypto from an airdrop. The snapshot is something that the crypto project will do at a certain date, the snapshot will tell them which wallets hold the coins needed to be eligible for the airdrop & how many you hold, again the more you hold the better. If you held Atom for example last year in 2021 in an eligible wallet you would have been able to claim many airdrops, like Juno, STARS, Osmosis & lots more. Some airdrops are automatically distributed, while others require a little more effort like doing a required number of steps. Here is a reddit thread that gives all the listed airdrops in the Cosmos ecosystem & the instructions on how to claim them. So now that you have a basic understanding of airdrops, you have some choices of what to do with your free cryptocurrency. You can either start staking that to earn more of that particular cryptocurrency or you can swap it for another cryptocurrency like Atom or one of the many other cryptocurrencies in the Cosmos ecosystem. “How do you do that?” you may ask. I’ll answer that next.

Decentralised Exchange, also known as a DEX.

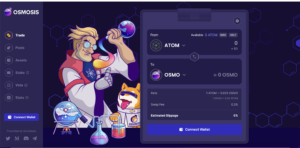

Now we have the really interesting part of this whole Cosmos ecosystem & where it really shines & that’s the ability to seamlessly swap between all manner of different cryptocurrency that are part of this ecosystem in a very easy & fast way. Currently this is done on the Osmosis DEX here but a new one called JunoSwap DEX has arrived, check that out here. At the time of writing I’m using the Osmosis DEX as its simple to use & fast. Transactions are done lighting fast & once you get used to it, which does’t take long you will understand what I mean. Check out the image below of the Osmosis home page, you will see how to use the exchange with a little guidance from me in the following images. First you will need to connect your Keplr wallet, so click the blue button saying ” Connect Wallet” once connected your ready to go.

Next you want to click on “Assets” and you will see a list of the various different cryptos, click on which one you want to swap, so for example you will have Atom already in your Keplr wallet. You might want to swap this for Osmosis, what you do is to select Atom in the list & select “Deposit” and remember to leave a little back for transaction fees. Once this deposit arrives which will take only seconds usually it will show as a balance on that page under Assets, in this case Cosmos hub – ATOM. Next click “Trade” just up from the “Assets’ tab.

Now under “Trade” the window will pop up to the right showing the options to select different cryptos. So in the case Atom & Osmosis are already selected by default to swap. Now just select the amount you want to swap which is usually MAX as you normally only deposit to the balance what you want to swap & then just click the “Swap” button just below. Now you will have a new balance of Osmosis & that is how you swap between any of the Cryptocurrencies in the Cosmos ecosystem.

Congratulations, you just traveresed the Cosmos on a short journey from start to finish, wasn’t as difficult as you thought was it? Now go and enjoy your new found skill & explore the Cosmos in all its decentralized glory & go multiply that crypto 🙂

If you want to learn more & enjoy further aspects of the Cosmos, things like liquidity pools with high APR’s, go check out this guy on YouTube he goes into further detail & his whole goal is to earn as much APY as possible & increase his token holdings.